Working Papers

* Sponsored Search: How Platforms Exacerbate Product Market Concentration

Submitted

Abstract

Draft

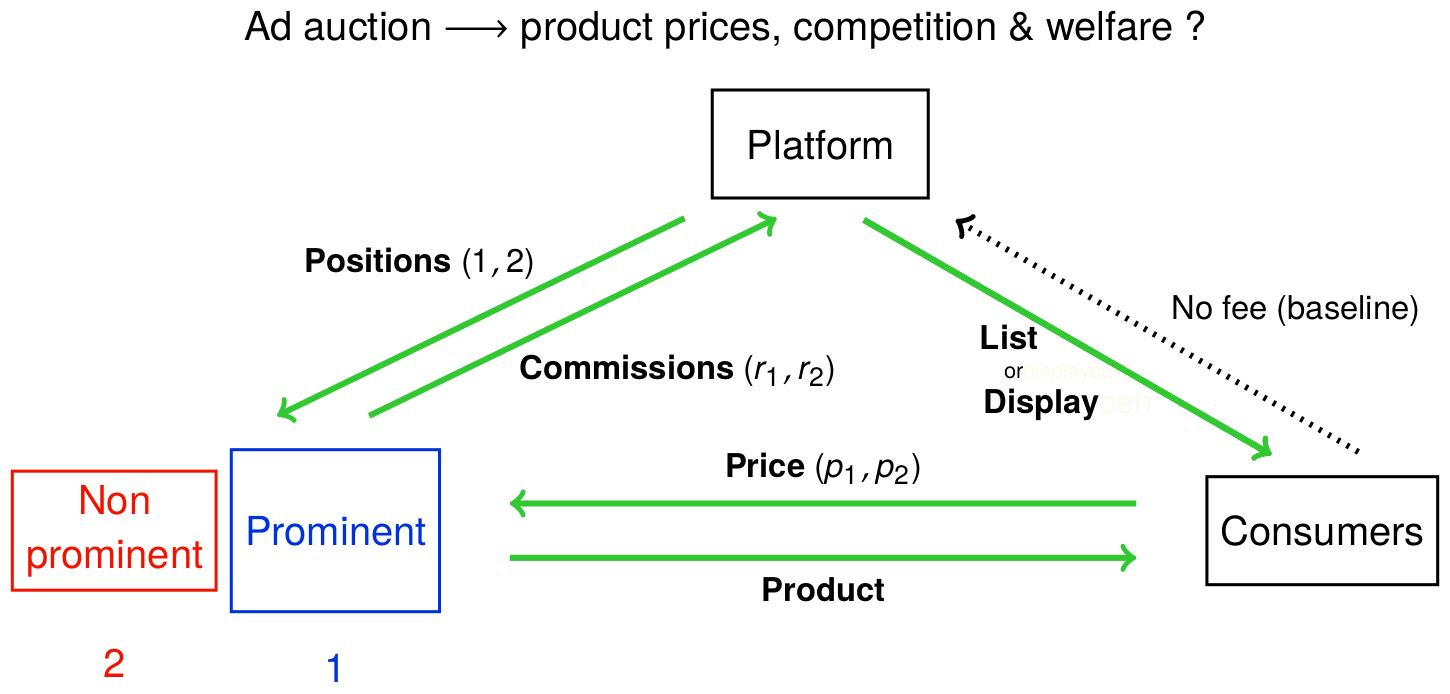

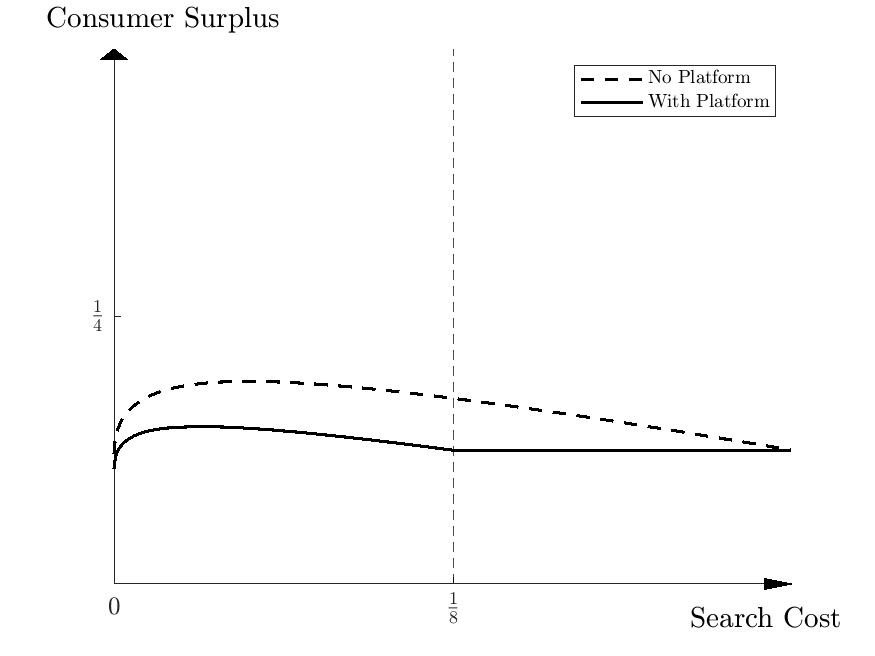

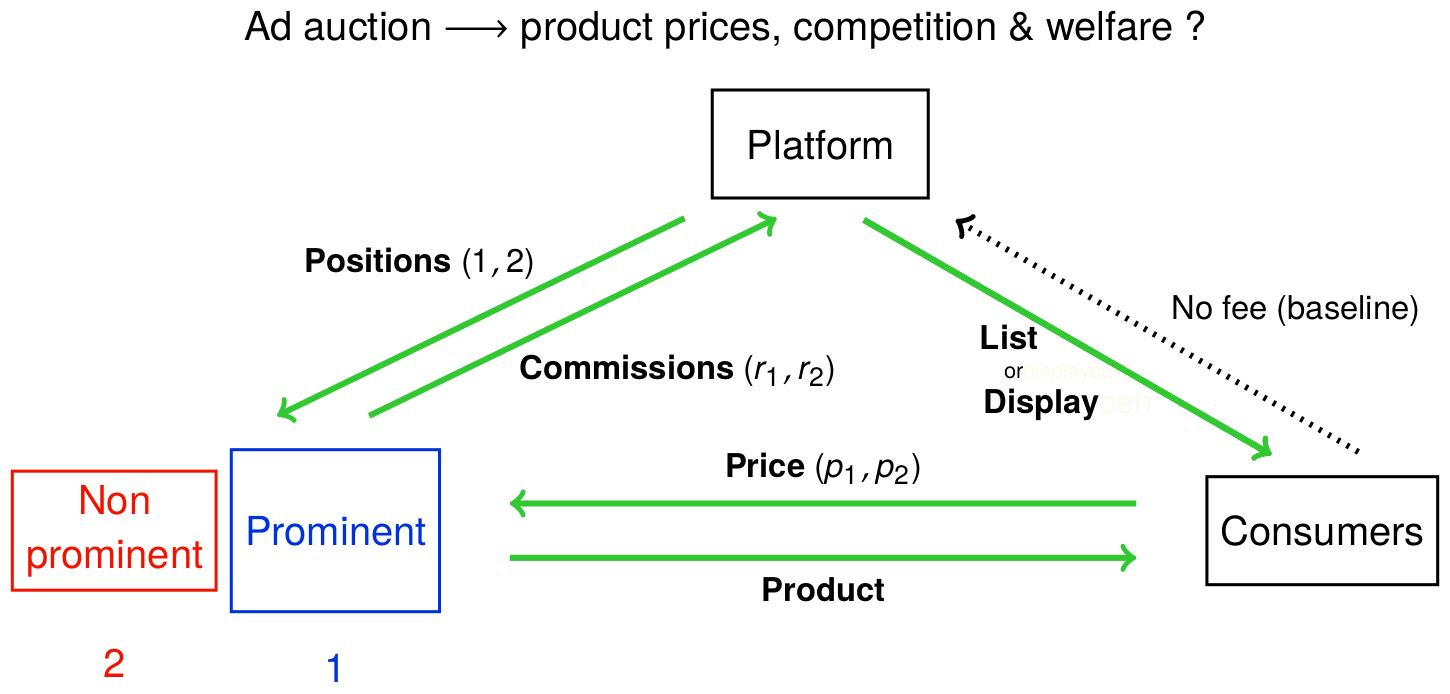

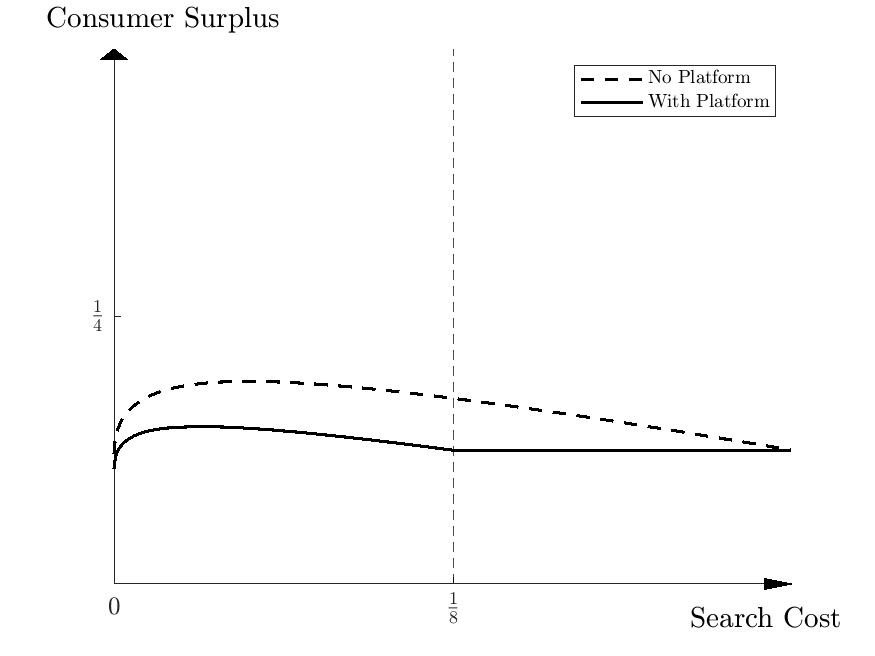

How do sponsored advertisements affect product market concentration, through

their effects on firms' pricing and consumer behaviour? To analyse this,

I develop a theory of digital markets where an intermediary provides a

platform for firms to advertise their product and where consumers need to

engage in costly search if they want to learn about the product characteristics.

First, I show that when prices are observable prior to the costly product

inspection, the less prominent (lower in the search order) firm is forced to

lower its price in order to attract more visitors, thus putting it at a competitive

disadvantage. Second, I augment this model by allowing the intermediary

to determine endogenously, through an auction, the order in which products

are displayed and the advertising commissions to be paid (per-click). I show

that the pass-through from these commissions to product prices is actually

higher for the less prominent firm, thus further putting it at a competitive

disadvantage. In equilibrium, these asymmetries in consumer price elasticity

and commission pass-through lead to lower competition, consumer surplus

and total transactions in the product market. Third, I show that the pay per-

click business model is intermediary-optimal while the pay per-sale and the

consumer subscription fee models improve consumer surplus at the expense of

the intermediary. Fourth, I provide novel empirical evidence that is consistent

with some key predictions of the model. These results contribute to the ongoing

policy discussions on the effect of dominant digital platforms on product market

concentration.

* Sleeping With The Enemy? How Constituents Constrain Politicians’ Behavior Towards Interest Groups

with Miguel Espinosa and Sergio Galleta and Giorgio Zanarone

Revise and Resubmit: The Journal of Law, Economics, & Organization

Abstract

Draft

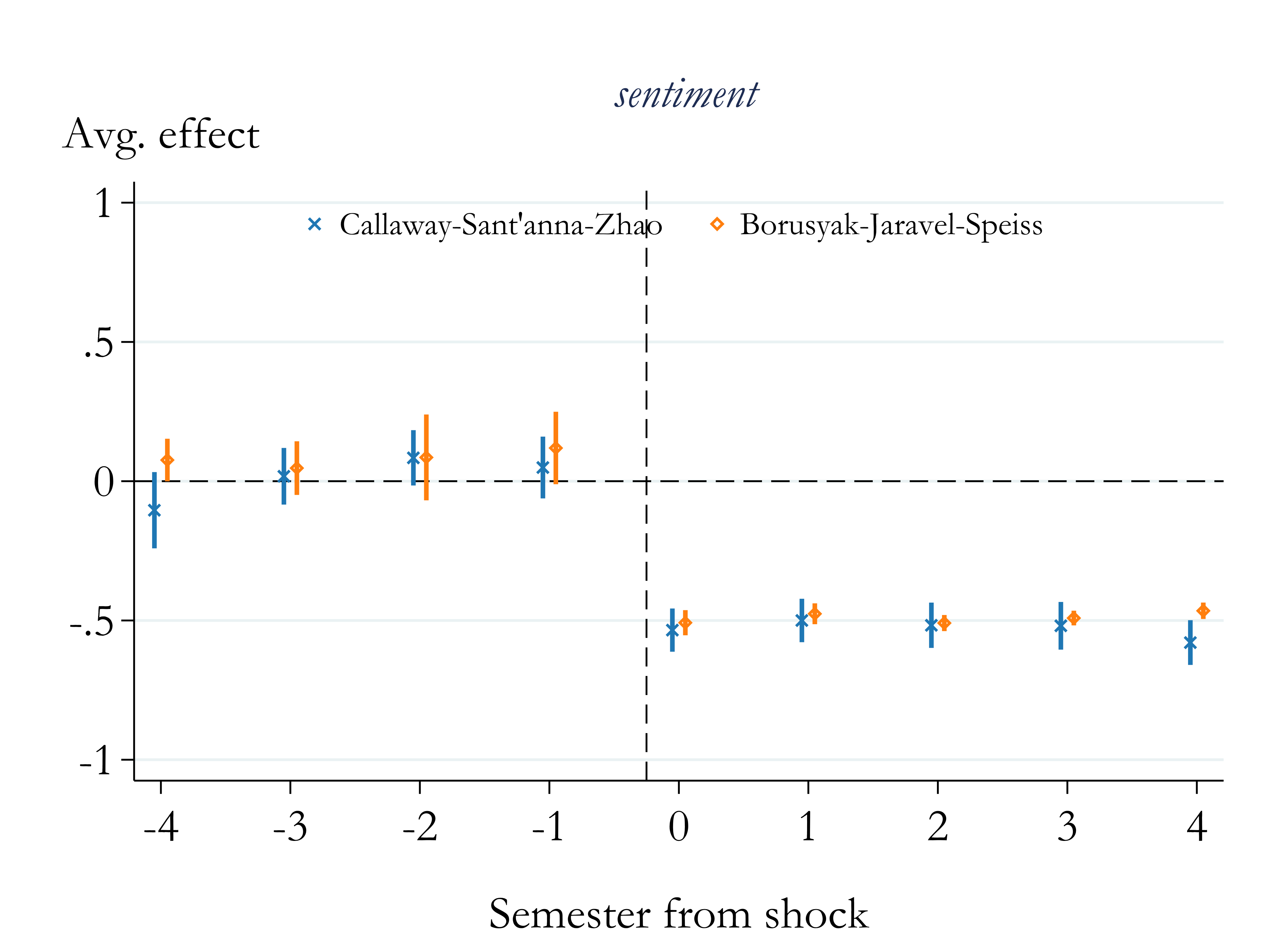

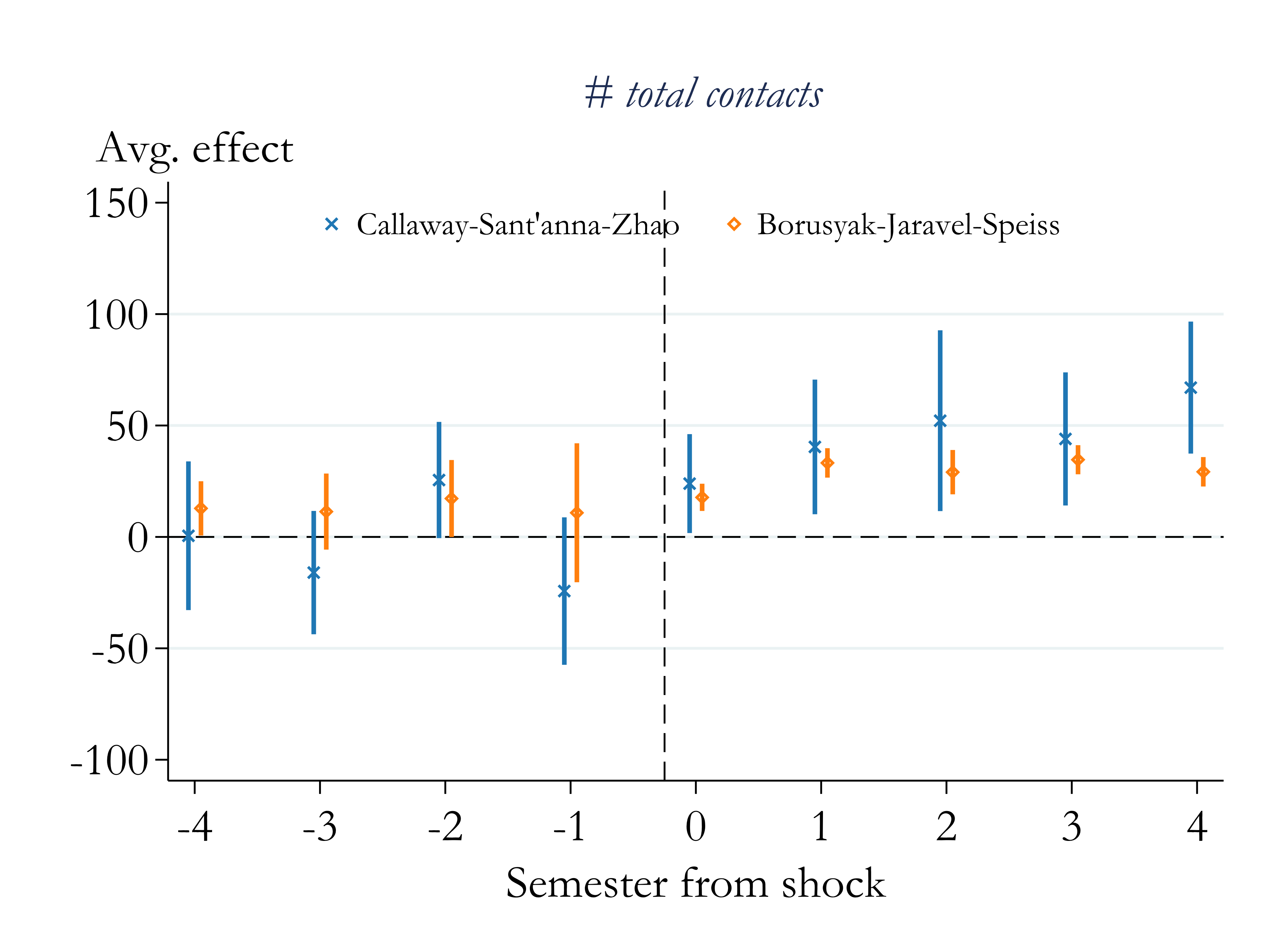

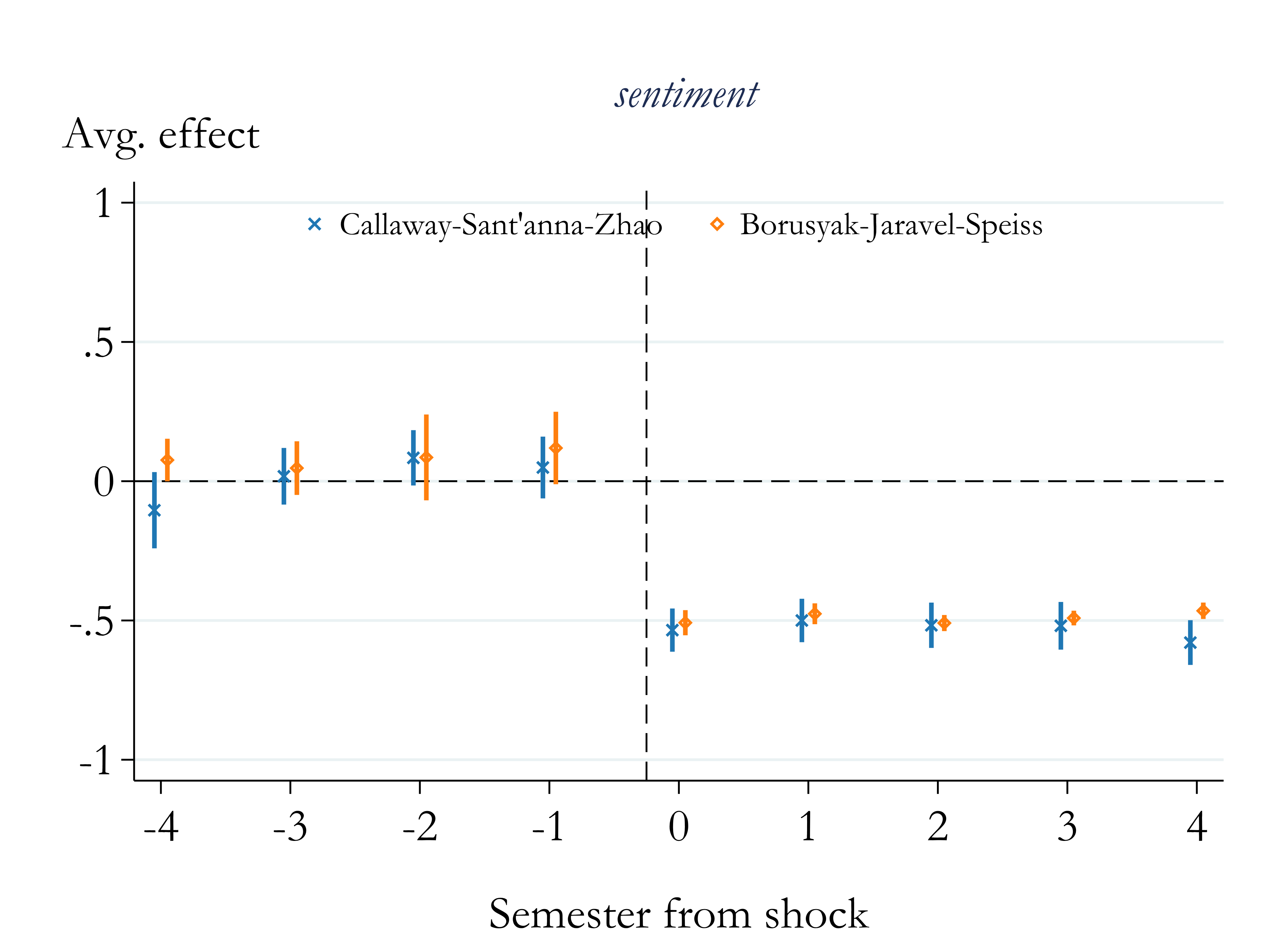

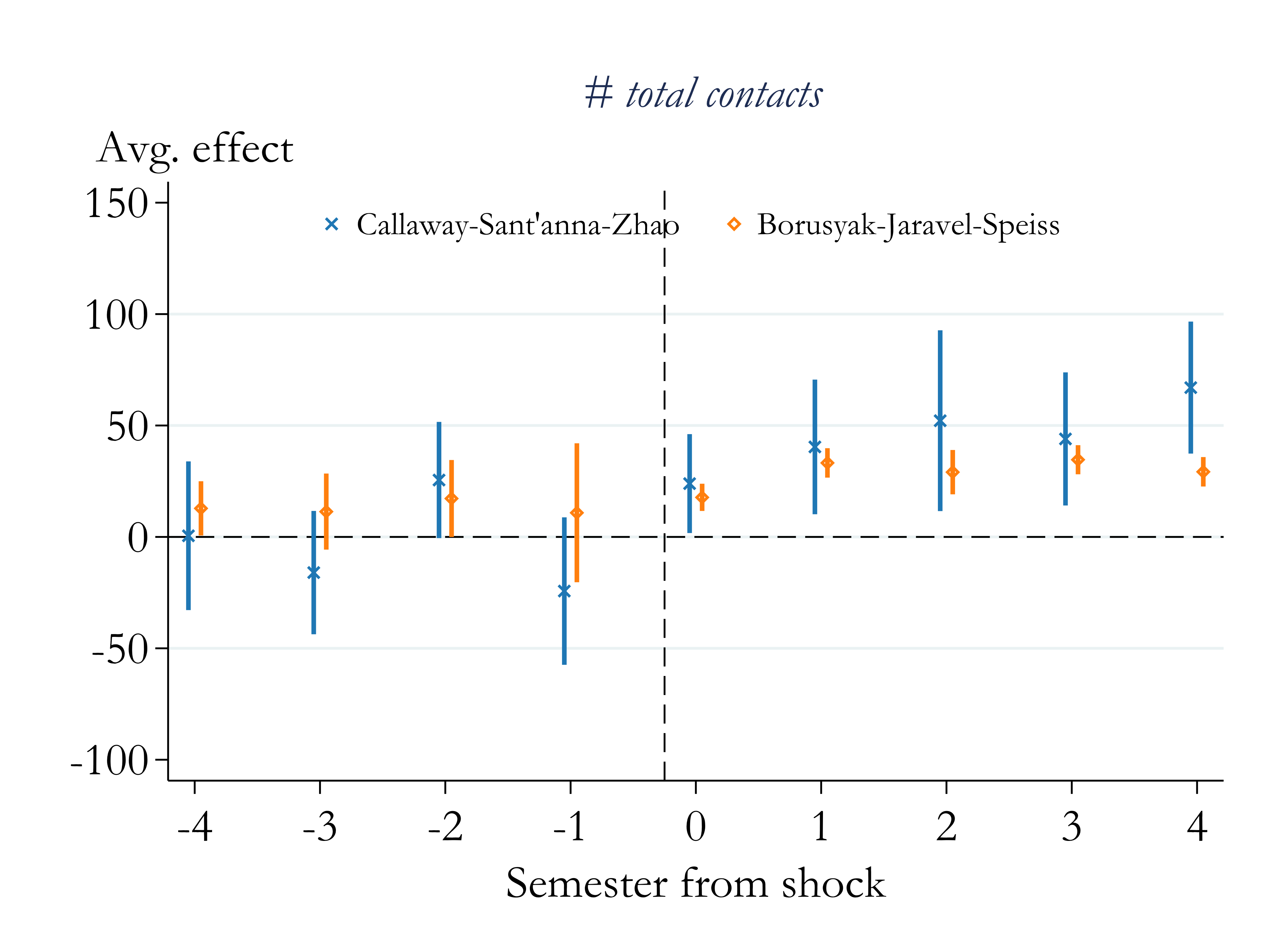

Do constituents limit interest groups' influence over elected officials? Using new data on congressional speeches, campaign donations, and over 10 million lobbying contacts from FARA filings, we track politicians’ responses to international events that raise the political cost of appearing too close to foreign governments. We find three main results. First, politicians strongly connected to shocked countries lose local campaign contributions after a shock. Second, they are less willing than weakly connected politicians to praise the affected country in their speeches. Third, while weakly connected politicians increase in-person meetings with the lobbyists of shocked countries, strongly connected ones shift to remote contacts. We show that a simple relational contracting model can explain these findings. Overall, our study suggests that politicians' concern with their constituents' reaction can deter foreign influence—but only partially. Politicians and interest groups adjust to reputational shocks, forming new ties and reshaping old ones to navigate public scrutiny.

* Identity, Market Access, and Demand-led Diversification

with Sampreet Goraya

Submitted

Abstract

Draft

Summary

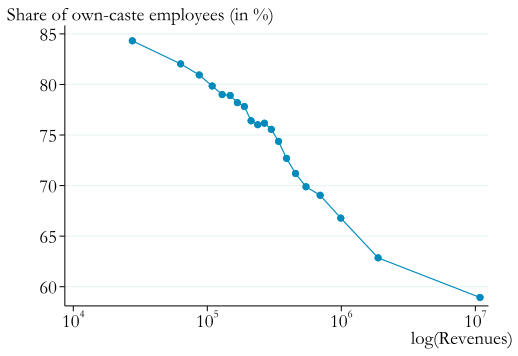

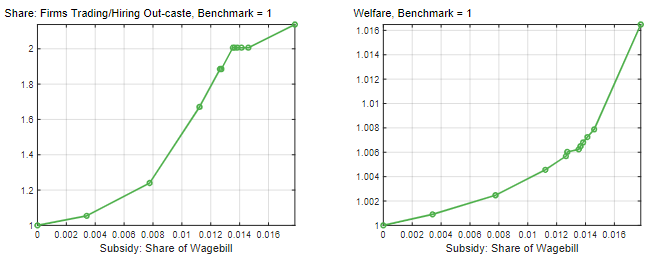

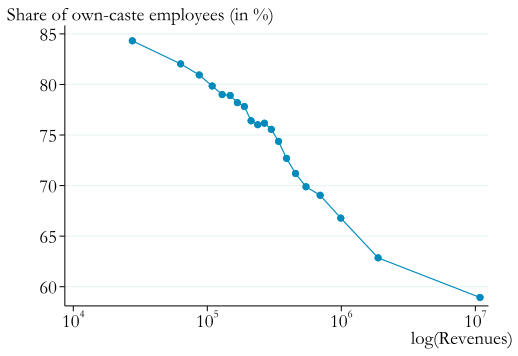

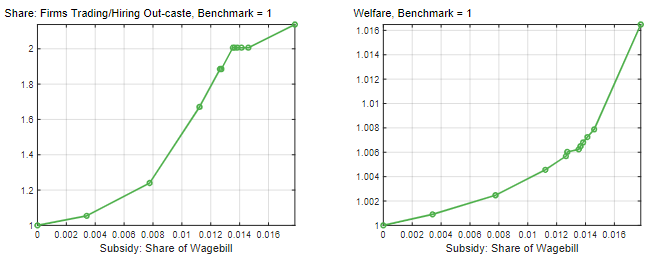

Using Indian microdata on employer-employee caste composition and household consumption, we document demand segmentation along caste lines, limiting firms' market penetration and reducing firm size in the economy. We develop a model where consumers prefer goods produced by socially closer groups, and firms overcome these barriers by hiring employees from the target consumer group. We identify the structural parameters governing demand segmentation using rainfall-induced demand shocks. Counterfactuals indicate that social identity-driven barriers restrict the growth of high-quality firms while sustaining low-quality ones. Lowering the cost of hiring out-group employees expands firm size by improving market access and enhances consumer welfare through greater variety of products.

* Application Compatibility in the Presence of Preference for Variety

with Gaurav Jakhu

Submitted

Abstract

Draft

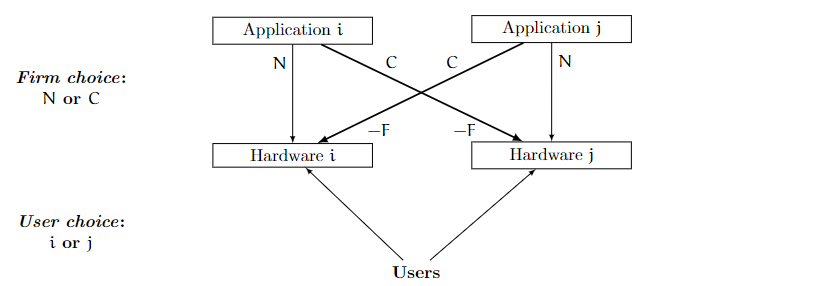

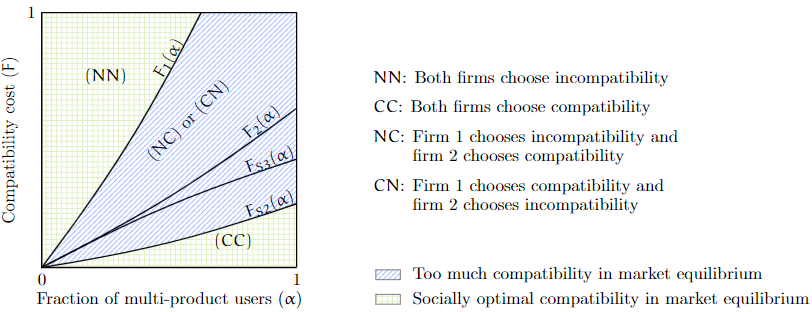

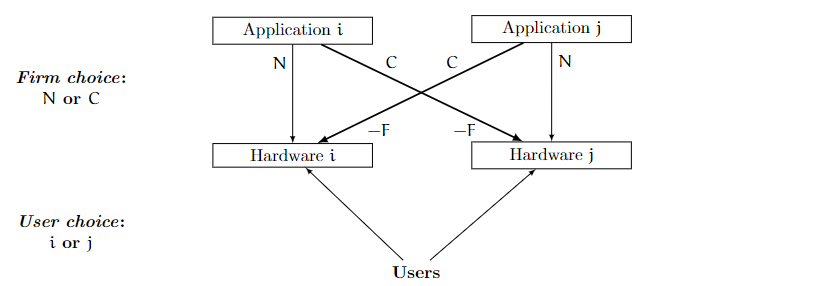

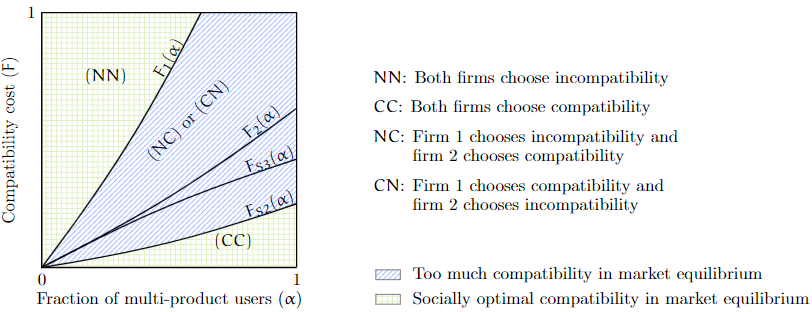

With the rising relevance of digital products, there has been an increased regulatory focus on understanding the competitive dynamics of digital ecosystems. Using

a theoretical model, we examine competition between two multi-product firms, each

selling hardware and an application, where each firm decides on the compatibility of

its application with the rival hardware device. Distinct from previous work, we take

into account consumers’ preferences for variety of applications. We find that, even with

ex-ante symmetric firms, an asymmetric compatibility regime (with one firm choosing

compatibility and the other firm choosing incompatibility) can arise in equilibrium.

Moreover, the likelihood of an asymmetric compatibility regime is higher in markets

with a higher fraction of users consuming both hardware and applications, weaker

hardware device diff erentiation, higher per-user advertising revenue, and lower per-

unit nuisance cost of advertisements. Also, from a welfare point of view, we find that

full compatibility is not always socially optimal.